Question & Answer

Q. Why should I buy VIRA instead of traditional annuities?

A. VIRA maintains the appealing features of traditional annuities such as providing a steady stream of income and remedies their shortcomings such as loss of control over the annuitant’s money, lack of capital appreciation potential, inflexible payout rate, and a relatively high expense ratio. See the Comparison section under the About VIRA navigation bar for more information. Unlike traditional annuities, VIRA does not guarantee a lifetime income stream as such. However, VIRA strives to provide a lifetime income and effectively guarantees a minimum amount of income for life through the built-in conversion option. In addition, VIRA has features that would help its holders ease the financial burden in the event of long-term care or critical illness.

Q. VIRA is not an insurance policy. How can VIRA guarantee a minimum amount of income for life?

A. VIRA consists of two subaccounts: Payout and Reserve Account. VIRA holders are allowed to convert the balance in the Reserve Account into a SPIA (Single Premium Immediate Annuity) when the balance in the Payout Account is depleted (or even before), effectively guaranteeing a minimum amount of lifetime income.

When you deposit money into VIRA, your money is split 90/10 to 60/40 between the Payout and Reserve Account, depending on your age. In addition, two percent of the balance in the Payout Account is transferred to the Reserve account every year. VIRA manages the assets held in the Reserve account to preserve as much the balance as possible so that the balance can be converted into a SPIA when VIRA is unable to make the scheduled income to its holder due to depletion of the balance in the Payout Account.

Q. What is the purpose of the conversion option built in VIRA?

A. VIRA holders are exposed to longevity risk if the balance of the Payout Account happens to be depleted prematurely for whatever reason (e.g., frequent or excessive withdrawals of money from the Payout Account in addition to scheduled payouts). In such an event, VIRA holders can protect themselves from longevity risk by converting the Reserve Account into an SPIA.

Q. The expected monthlty logarithmic real return for the Payout Account used in estimating the probability of insovency seems to be significantly higher than the historical mean return for a traditional 60/40 porfolio. Can you guarantee such a high expected return for the Payout Account?

A. VIRA’s tail risk hedge portfolio is the major contributor to enhancing the expected monthly logarithmic real return for the Payout Account. The expected monthly return without the tail risk hedge portfolio would be 0.68% compared with 1.02% with the hedge portfolio. The tail risk hedge portfolio is such an integral part of VIRA that we have spent several years developing the tail risk hedge strategies. Although we cannot guarantee the future performance of the tail risk hedge portfolio, we are cautiously confident in VIRA’s tail risk hedging strategies.

Q. How much annual income does VIRA guarantee for life?

A. It would depend on how fast the balance of the Payout Account is depleted, which, in part, depends on the payout rate selected by yourself. Consider a couple who jointly puts $100 into VIRA, and selects an annual payout rate of COLA (cost-of-living adjusted) five percent. Suppose that the initial money is split 90/10 between the Payout and Reserve Account, and the assets deposited into the Reserve Account make an expected monthly logarithmic real return of 0.25% along with a standard deviation of 2.23% (See the Asset Management section to learn how the expected return and risk are estimated).

The following table shows the minimum, median, and maximum possible amount of income for life 12 to 35 years from today.

| Years from today | 12 yrs. | 15 yrs. | 20 yrs. | |||

| COLA Balance | NoneCOLA Annual Annuity Income | COLA Balance | NonCOLA Annual Annuity Income | COLA Balance | NonCOLA Annual Annuity Income | |

| Minimum | $22 | $1.69 | $25 | $2.09 | $32 | $3.18 |

| Median | $43 | $3.30 | $53 | $4.44 | $72 | $7.15 |

| Maximum | $93 | $7.15 | $120 | $10.04 | $167 | $16.58 |

| Years from today | 25 yrs. | 30 yrs. | 35 yrs. | |||

| COLA Balance | NonCOLA Annual Annuity Income | COLA Balance | NonCOLA Annual Annuity Income | COLA Balance | NonCOLA Annual Annuity Income | |

| Minimum | $35 | $4.36 | $42 | n/a | $42 | n/a |

| Median | $94 | $11.72 | $119 | n/a | $148 | n/a |

| Maximum | $273 | $34.03 | $409 | n/a | $523 | n/a |

Q. When is the balance of the Payout Account expected to be depleted given the payout rate chosen?

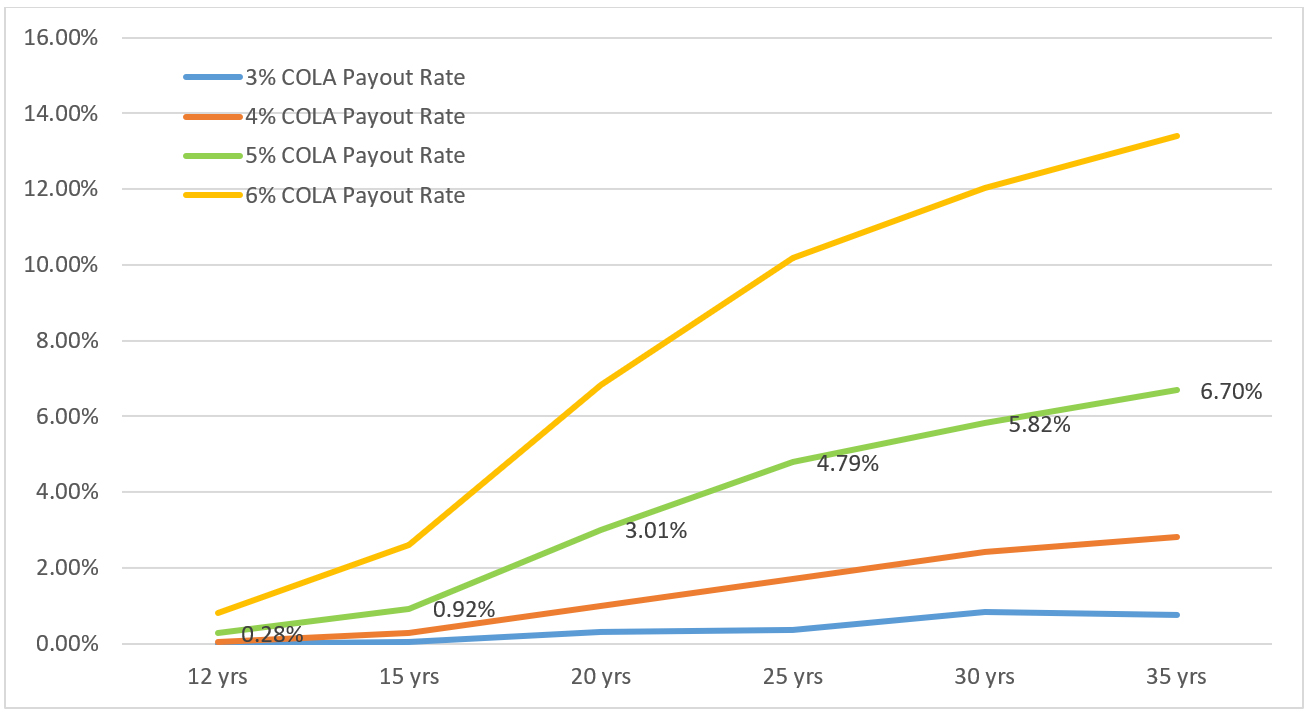

A. The following figure illustrates the probability of depletion of the balance in the Payout Account. The probability of depletion is estimated based on an expected monthly logarithmic real return of 1.02% and a standard deviation of 4.26%. See the Asset Management section to learn how the expected real return and standard deviation are estimated.

Estimated probability of depletion of the balance in the Payout Account with four different payout rates

* COLA is short for Cost-Of-Living-Adjusted

Q. What is the expense ratio of VIRA?

A. VIRA charges an annual management fee of 0.35% and 0.10% for the Reserve Account and the Reserve Account, respectively, plus the expense ratio charged by ETFs held in VIRA. The vast majority of the assets held in VIRA are individual securities, but VIRA may also invest a small percentage of AUM in ETFs.

Q. What is the minimum required investment for VIRA?

A. The minimum required investment is as low as $1,000 if you defer payouts until sometime in the future. If you need payouts immediately, the minimum required investment is $50,000.

Q. Who is the investment manager of VIRA?

A. Retirement Income Security LLC (RISC) serves as the investment manager. RISC is a startup fintech/service company located in East Greenwich, RI, and Greenwich, CT, and led by Eugene Lee, Ph.D., CFA. Dr. Lee founded Retirement Income Security, LLC in 2016 and currently serves as its president & CEO. Eugene Lee received his M.A. in mathematics and Ph.D. in finance from the University of Texas at Austin. Dr. Lee has published many articles in prestigious academic journals such as Econometrica and the Journal of Financial Economics by his legal name, Yul W. Lee. He has more than 30 years of investment management experience and was chosen as one of the next-century business leaders in the State of Rhode Island by the Providence Journal, the leading newspaper in Rhode Island, in 1999. He has developed VIRA, and the Stable SPX, a stable version of the S&P 500 Index for investors with low-risk tolerance. For more information about RISC, visit www.risc.co.

Login

Login